Calculations must be performed quarterly. Working 2 Tax benefits on tax allowable depreciation TAD The examiners normal assumption is that an asset is bought at the start of the first year of the project and hence the first TAD is available for Year 1.

A058 Fixed Assets Depreciation Sql Accounting Software Youtube

The tax legislation only provides a 2 rate of tax depreciation per year for immovable property except for land.

. Depreciation of fixed assets. A statement of cash flows. When you assign an asset type to a new fixed asset the types settings are automatically applied to the asset.

Updating the replacement values of. An alternative to the fixed rate TPS is the floating rate TPS. The real rate r of 77 and the general inflation rate h of 4 must be expressed as decimals when using the Fisher formula.

Malaysia 60 Mexico 64 New Zealand 68 Singapore 70 South Africa 75 South Korea 80 Spain 83 Taiwan 86 Thailand 88 The Netherlands 90 Turkey 94 United Kingdom 98 United States of America 102 Contents. First year 260. Generally depreciation is calculated by the straight-line method.

Dr Depreciation expense Cr Accumulated depreciation. A statement of financial position balance sheet. A statement of changes in equity.

The annual allowance is given for. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Theft - The unlawful taking of property of another.

This expense charged every year is called depreciation. Changes to the program included the minimum monthly income required being raised from RM10000 a month to RM40000 9100 Another major increase is the required Fixed Deposit to RM1 million 227505. The term includes such crimes as burglary larceny and robbery.

The financial crisis heavily damaged currency values stock markets and other asset prices in many East and Southeast Asian countries. Replacement Cost Actual amount required to repair or replace your vehicle minus depreciation. This method of calculating the depreciation of an asset assumes that it depreciates uniformly in value over its effective life.

In general terms accounting criteria are followed to calculate tax depreciation. IFRS financial statements consist of. For example if the depreciable value of an asset is 1300 and you.

All fields are mandatory. Trust preferred securities are rated by nationally recognized rating firms. This is because Malaysias luxury real estate industry relies heavily on foreign investors.

Under-Insurance - A condition in which not enough insurance is purchased to cover the total cash or market value of the insured asset. Lease rentalinterest When you look at a lease agreement it should be relatively easy to see that there is a finance cost tied. For other assets the tax legislation does not provide any lives or rates.

However other criteria could be adopted if there are. Capital allowances consist of an initial allowance and annual allowance. Tax accounting workflow and firm management solutions to help your firm succeed with the research tools you need to stay sharp.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Enter a rate of 20 the annual depreciation for the first three years is. Presentation of financial statements.

You need to choose one of depreciation rate or effective life. Annual depreciation by multiplying the depreciable value of the asset less previous depreciation by the depreciation rate. Such assets are capitalized and not charged to expenses when they are bought.

Finance is the study and discipline of money currency and capital assetsIt is related with but not synonymous with economics the study of production distribution and consumption of money assets goods and servicesFinance activities take place in financial systems at various scopes thus the field can be roughly divided into personal corporate and public finance. Tracking each assets value both from a tax and an accounting point of view. Following the initial capitalisation of the leased asset depreciation should be charged on the asset over the shorter of the lease term or the useful economic life of the asset.

You can edit the depreciation settings for a particular asset but you cant change the accounts. The accounting for this will be. To use this method the following calculation is used.

By reducing the interest-rate risk these products have significantly less attractive coupons than the fixed rate products. Get 247 customer support help when you place a homework help service order with us. As per the US Food and Drug Administration USFDA Form 483 is issued to a firms management at the conclusion of an inspection when an.

Shares of Biocon were trading nearly 4 per cent lower in Thursdays trade after the USFDA issued Form 483s with 11 observations each for two sites in Bengaluru and six observations for a plant in Malaysia. Every year a small portion of its cost is expensed and is allowed to be reduced from your income. Managing your fixed assets includes the following tasks.

While annual allowance is a flat rate given every year based on the original cost of the asset. Production-nature biological assets such as livestock held for breeding and commercial timber also have to be. Assets cost days held 365 100 assets effective life.

Fixed assets with useful lives of more than 12 months must be capitalised and depreciated in accordance with the CIT regulations. Depreciation When you purchase a capital asset the benefit of such an asset is usually expected to last more than a year. A statement of comprehensive incomeThis may be presented as a single statement or with a separate statement of profit and loss and a statement of other comprehensive income.

Monthly depreciation using the full month averaging method. No longer able to support its exchange rate the government was forced to float the Thai baht which was pegged to the US. On July 2 1997 the Thai government ran out of foreign currency.

Property owners have two ways of calculating depreciation on their assets. The coupon for the floating rate issues may be based on a short-term rate such as three-month LIBOR plus a spread. Depreciation rate or effective life.

Worldwide Real Estate Investment Trust REIT Regimes Compare and contrast 3 During the past years Real Estate Investment Trusts REITs have had a strong come. Depreciating assets correctly using an appropriate depreciation rate and method.

![]()

Choosing Asset Management Software Important Considerations Hardcat Asset Solutions Asset Management

Bunge Stock Profitability Is An Illusion Nasdaq

Choosing Asset Management Software Important Considerations Hardcat Asset Solutions Asset Management

Debt Issuance Fees Overview Accounting Treatment Amortization

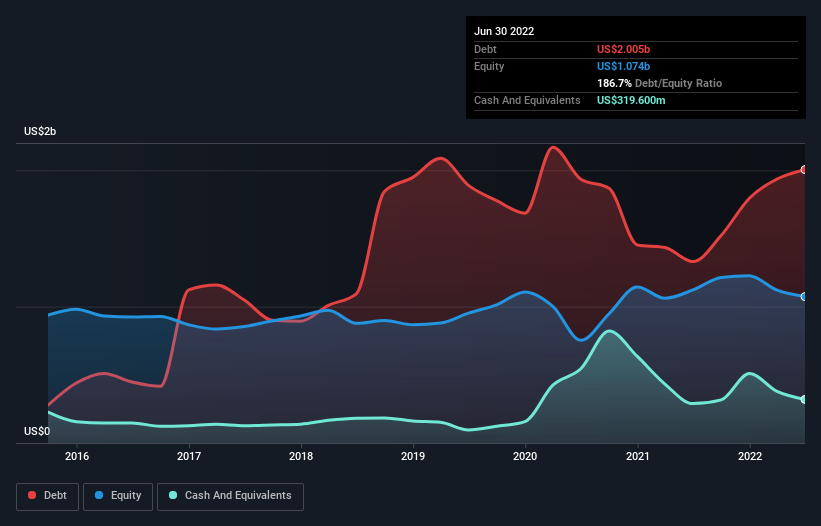

We Think Polaris Nyse Pii Is Taking Some Risk With Its Debt Nasdaq

What Is Asset Tagging Why Businesses Should Start Doing It

Tangible Asset Stock Photos Royalty Free Tangible Asset Images Depositphotos

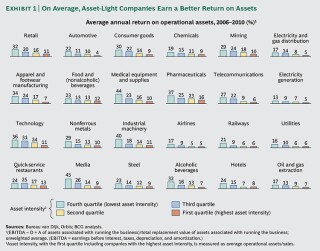

Bunge Stock Profitability Is An Illusion Nasdaq

Market Outlook Manulife Investment Management

Nonprofit Accounting Financial Statements Accountingcoach

Fully Depreciated Asset Overview Calculation Examples

Market Outlook Manulife Investment Management

Establishing The Connection Between Successful Disposal Of Public Assets And Sustainable Public Procurement Practice Sciencedirect

/dotdash_Final_Equity_Derivative_Aug_2020-01-8b165b177a3a4a06951b2c33dede9f8a.jpg)